DeFi Leverage for Tokenized Assets

The tokenization of so-called "real world" assets is all the rage, and you'll hear its proponents sing its praises on the basis of the operational efficiencies and expanded distribution that can be unlocked by tokenizing assets on a blockchain (which means creating a representation of an asset in a blockchain format, often called a token, which gives its holders some form of ownership or exposure and a defined path to redemption1).

The reality is that we see a lot of tokenization for the sake of tokenization, made possible by generous incentivization from competing blockchains.

Asset issuers and managers want to grow their assets and AUM, and are happy to receive investment from crypto treasuries, DeFi funds, blockchain foundations and the like, or pass crypto incentives to their existing LPs which can often receive them by simply holding tokenized assets on a specified blockchain, leaving them completely idle.

Missing the forest for the trees

The real opportunity lies in fully utilizing tokenized assets to create structured DeFi products that are uniquely possible in DeFi and can therefore be attractive to traditional investors.

While it is true that DeFi protocols are significantly less sophisticated than the traditional financial services they emulate, they make up for this with programmability and composability. They can enable the automation of what would otherwise be extremely cumbersome (if possible at all) credit and capital flows.

An example of this is DeFi Looping which can offer enhanced yield via leverage on traditionally illiquid yield assets such as tokenized private credit funds.

Perpetual futures (perps) exchanges open up possibilities to create DeFi products for volatile assets such as indexes and commodities. Spot holdings of tokenized assets can be combined with a derivatives position on a DeFi perps exchange to form a basis trading strategy, which can be entirely automated using DeFi rails.

This is only scratching the surface: the realm of possibilities will expand as key challenges are addressed with regards to making tokenized assets compatible with DeFi.

Competitiveness of DeFi Loops

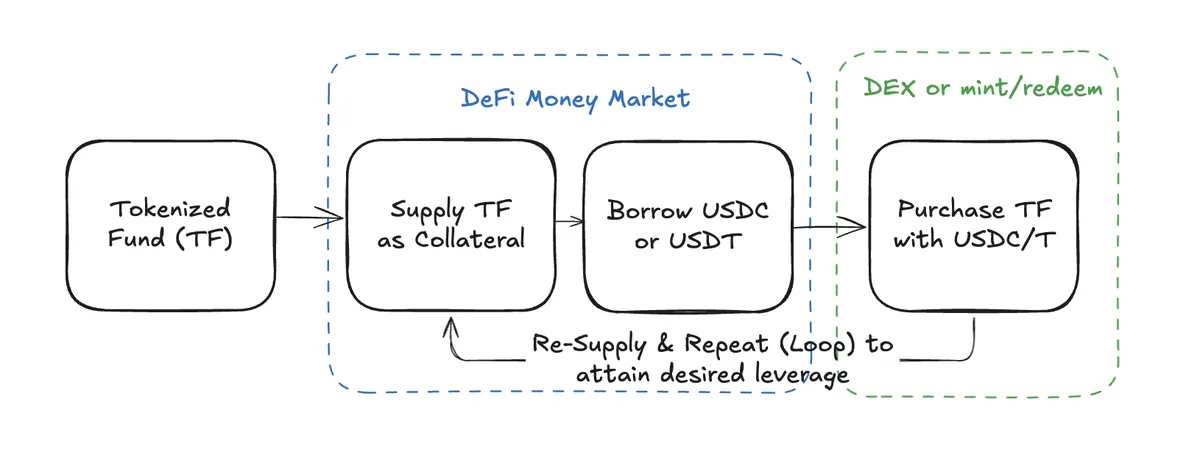

Looping perfectly illustrates the competitiveness of DeFi rails. Consider the flow of funds outlined below and ask yourself how you would replicate this outside of DeFi, using an LP share in a quarterly/monthly redemption fund as the starting point:

The value of composability cannot be overstated. The same exact tokenized asset can be seamlessly and instantly traded on exchanges of different types (order book, concentrated liquidity, AMM) and move between money markets (Aave, Morpho, Euler) including more unique undercollateralized lending protocols (Gearbox, Arkis) and unsecured lending (Wildcat, 3Jane). Composability, or the ability to interact with multiple protocols using the same asset, allows for automated arbitrage of borrow rates which can be built into strategies that can shift capital and adjust leverage within seconds.

This cannot be replicated in traditional finance, where running the same type of recursive borrowing using LP shares in a fund would already be cumbersome and require many individual loan agreements and credit assessments. Algorithmically adjusting the leverage, or instantly switching creditors and counterparties, sounds like a pipe dream in this context.

Liquidity and transferability

Such products are only possible if tokenized assets are properly integrated with the DeFi ecosystem. This does not automatically happen when a token is issued: it requires some level of transferability, bootstrapping liquidity on DeFi exchanges, creating live price feeds and onboarding DeFi market makers and liquidators that are able to mint and redeem the underlying assets.

The first challenge lays in creating a transferrable tokenized asset without breaking its path to redemption and inferred ownership rights. Centrifuge enables this through its decentralized RWA (deRWA) range, which can be actively traded on decentralized exchanges (Coinbase DEX, Jupiter). The alternative is to limit integrations to permissioned DeFi protocols, such as Aave Horizon, that are equipped to handle non-transferrable assets as collateral while still offering access to a more limited pool of assets to borrow.

In addition to this, there is a fundamental duration and liquidity mismatch that needs to be addressed.

DeFi expects everything to be continuous. This doesn't reflect how the traditional financial system works. It operates with discreet dates, durations and expiries for everything from disbursements, redemption windows, loan agreements and derivatives. Successful DeFi products (of which perpetual futures are the poster child) have managed to abstract this away, and the same will need to happen in the context of tokenized assets.

This need for abstraction creates new markets for early actors to step into, for example market makers that can accept and price duration and/or credit risk. This is also a potential area of growth and experimentation for traditional players that want to step into DeFi. We're in the early stages still: it will take subsidies and conviction to bootstrap appropriate onchain liquidity but the direction is clear and demand is growing.

New higher yield stablecoins backed by relatively illiquid assets (for eg. GPU loans) are coming up with solutions to address the aforementioned liquidity timing issue. The latest example is USDai's Queue Extractable Value (QEV) system which allows holders of the yield-bearing stablecoin to bid in a private pool for priority withdrawals (serviced by interest on loans) during liquidity crunches. QEV falls short of dynamic pricing but still defines the withdrawal dynamics for liquidations, which is taken into consideration when evaluating the yield-bearing stablecoin as a DeFi collateral.

Packaging and distributing DeFi structured products

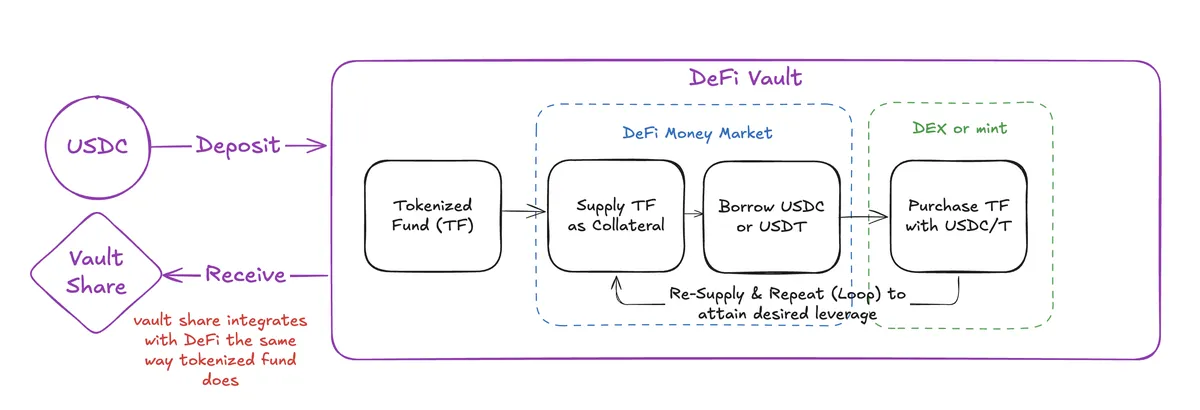

A DeFi strategy such as the one described above isn't exactly straightforward to replicate, but it can be managed by an onchain asset manager within a DeFi vault that accepts external deposits. The vault would then issue a vault share that is transferrable and offers exposure to the underlying strategy.

Capital isn't locked in the vault: the vault share token is subject to the same dynamics described earlier, and can itself be integrated with DeFi protocols, or turned into a fixed rate product using Pendle (detailed explanation of Pendle here).

The ease of accessing the strategy through a vault (instant processing of deposits) means that DeFi structured products can be widely distributed to non-crypto savvy investors. Integrations with custodians, institutional wallets and exchanges are a key part of distribution. Regular DeFi vaults are already getting integrated across all major exchanges and custody solutions/MPC wallets. Established vault standards make it trivial to add new vaults once the initial integration work has been completed. One could also expect new platforms to appear with the goal presenting DeFi structured products based on tokenized assets to more traditional investors in a format they recognize.

Enjoyed this blog post? Consider subscribing: